How Loan Officers Can Thrive in Today’s Challenging Market

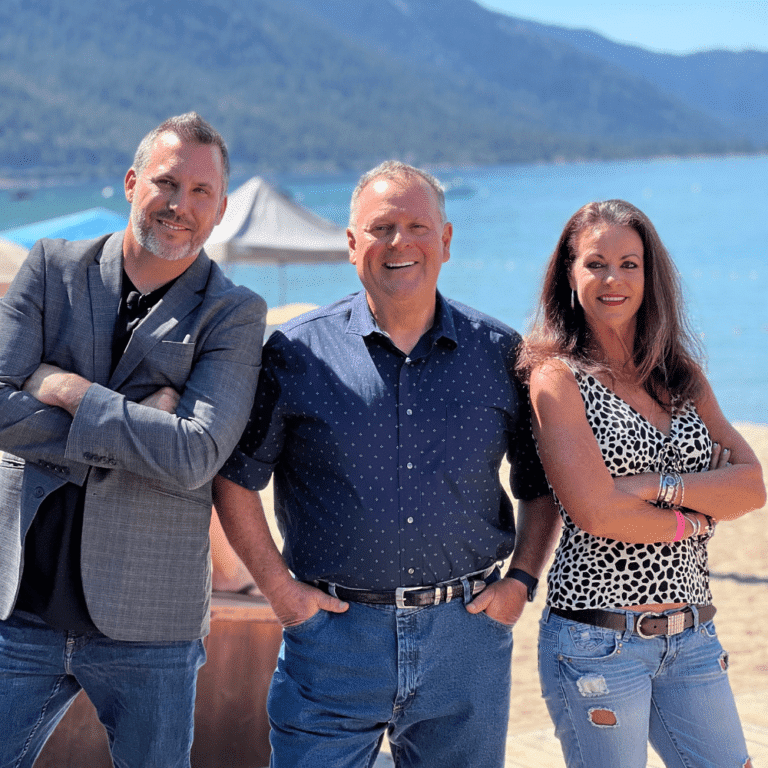

When people face challenging times, the natural human response is to freeze or flee. And loan officers are definitely facing some challenging times right now. I sat down recently with my partner, Ralph Watkins, to talk about how to persevere through the changes in today’s market. Ralph is the one who got me into the…